A recent survey shows that many people still aren’t getting coverage for their trips

A recent survey conducted by CAA showed that even though travel insurance rose in popularity during and following the pandemic, there remain many people who don’t purchase any coverage when they head away on business trips or vacations.

Despite the financial risks, about 40 percent travelers don’t always buy coverage

This means that forty percent of travelers are inconsistent about buying emergency medical or cancellation travel insurance, or never purchase it at all. This places a potential financial vulnerability in the spotlight.

“In a world of uncertainties, our survey highlights a critical gap in travel preparedness,” said CAA SCO director of corporate communications Kaitlynn Furse. “At CAA, we believe in empowering travellers with knowledge so they can explore confidently and securely.”

Without any travel insurance

According to the survey results, 23 percent – nearly 1 in 4 – went on their last trips without buying coverage in any form. This placed them at risk of financial hardships if an emergency were to have occurred. Moreover, 33 percent of those who traveled with coverage used the policy provided through their credit card, a form that commonly includes a range of limitations, particularly for travelers aged 65 years and older.

Medical claims for travelers are getting more expensive

According to Orion Travel Insurance claims data, there has been a 14 percent increase in the average medical claim cost since 2019.

“Costs associated with everything from an ear infection to the use of an air ambulance have risen over the last few years due to medical inflation, underscoring the continued importance of travel insurance for life’s unexpected complications,” said Furse.

Tips for Travelers

As a result of the results of the survey, CAA SCO released tips to help people to ensure they are protected against common issues faced while away from home. These included:

- Making sure all documentation has been obtained and is up to date before bookings are made.

- Reading any travel advisories applicable to the destination.

- Discussing travel plans with your doctor

- Purchasing travel insurance coverage at the time the trip reservations are made

- Understand cancelation policies for everything booked

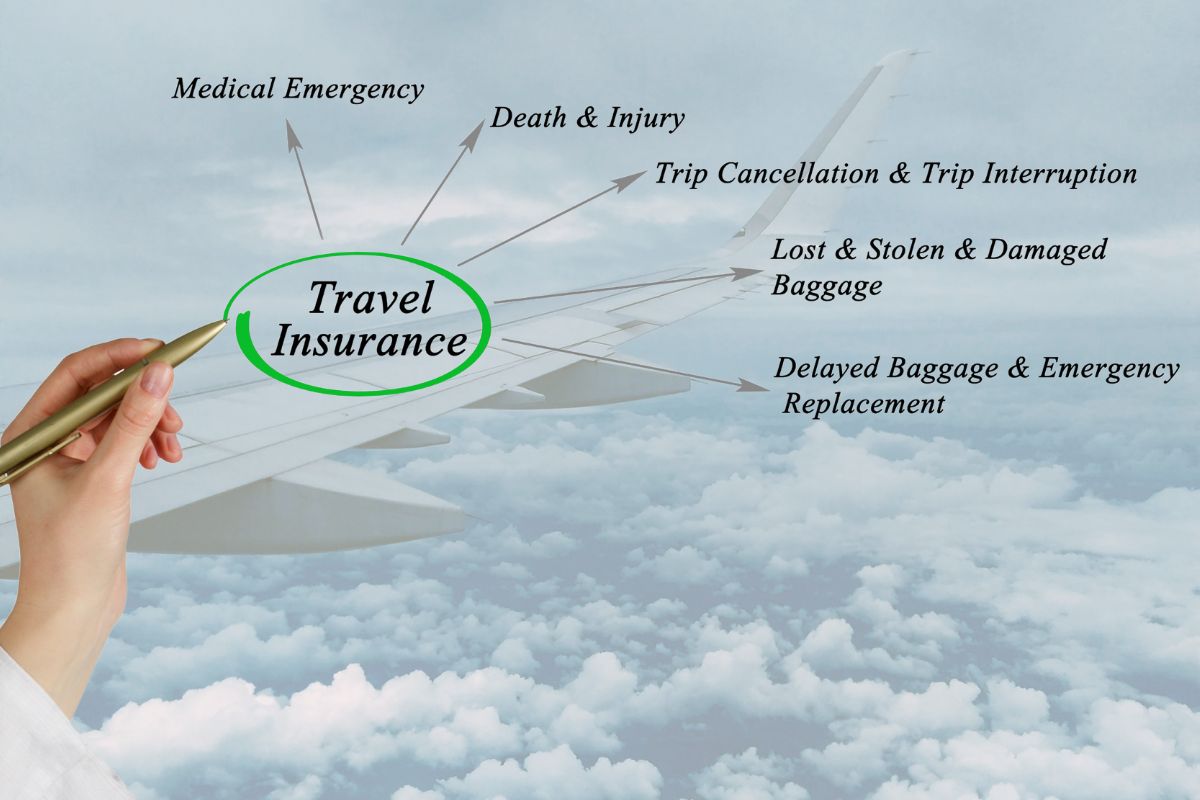

- Understanding limits and restrictions to coverage

- Arriving at the airport early

- Keeping emergency contact numbers in several places

- Staying up to date about any changes that could alter plans